You are here:

- National Payment System

- Legal & Regulatory Framework

Our Council

Due to the importance of the payment system to the economy, appropriate regulation is essential to ensure safety, soundness and efficiency of the NPS.

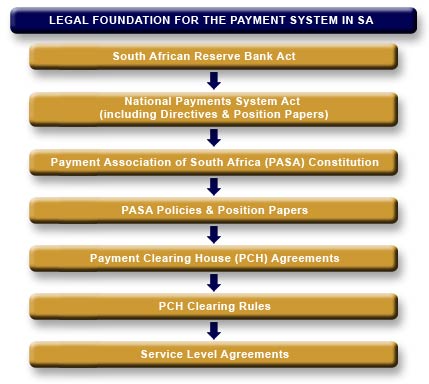

Effective regulation starts with a sound legal framework. The relevant legal framework and constructs are provided below.

The SARB Act mandates the SARB to oversee the regulation of the NPS and to ensure its safety, soundness and efficiency.

In turn the NPS Act, which was promulgated during 1998, mandates the SARB to recognise a Payment System Management Body (PSMB), to organise, manage and regulate its members participating in the NPS. PASA is currently recognised as the PSMB by the SARB.

In turn, PASA’s Constitution governs its functions, structures and activities, with further rules affecting its members in the form of PASA Policies and Position Papers.

In the PASA environment the legal foundation governing participation in a particular payment system is contained in a Payment Clearing House (PCH) agreement. The specific transaction types and applicable Clearing Rules relevant to each PCH are agreed amongst members forming part of a Participant Group (PG), which would be responsible for one or more PCH agreements.

The PCH Participant Group (PCH PG) would also be responsible for the appointment of one or more PCH Systems Operator (PSO) for each PCH, which would be authorised by PASA to facilitate clearing of payment instructions between the banks. The participation of members and the PSO is further managed through adherence to Service Level Agreements (SLAs). Transactions cleared through the PSO are eventually settled at the SARB through the Real Time Gross Settlement (RTGS) system called SAMOS (South African Multiple Options Settlement).

This framework is depicted in the diagram below.